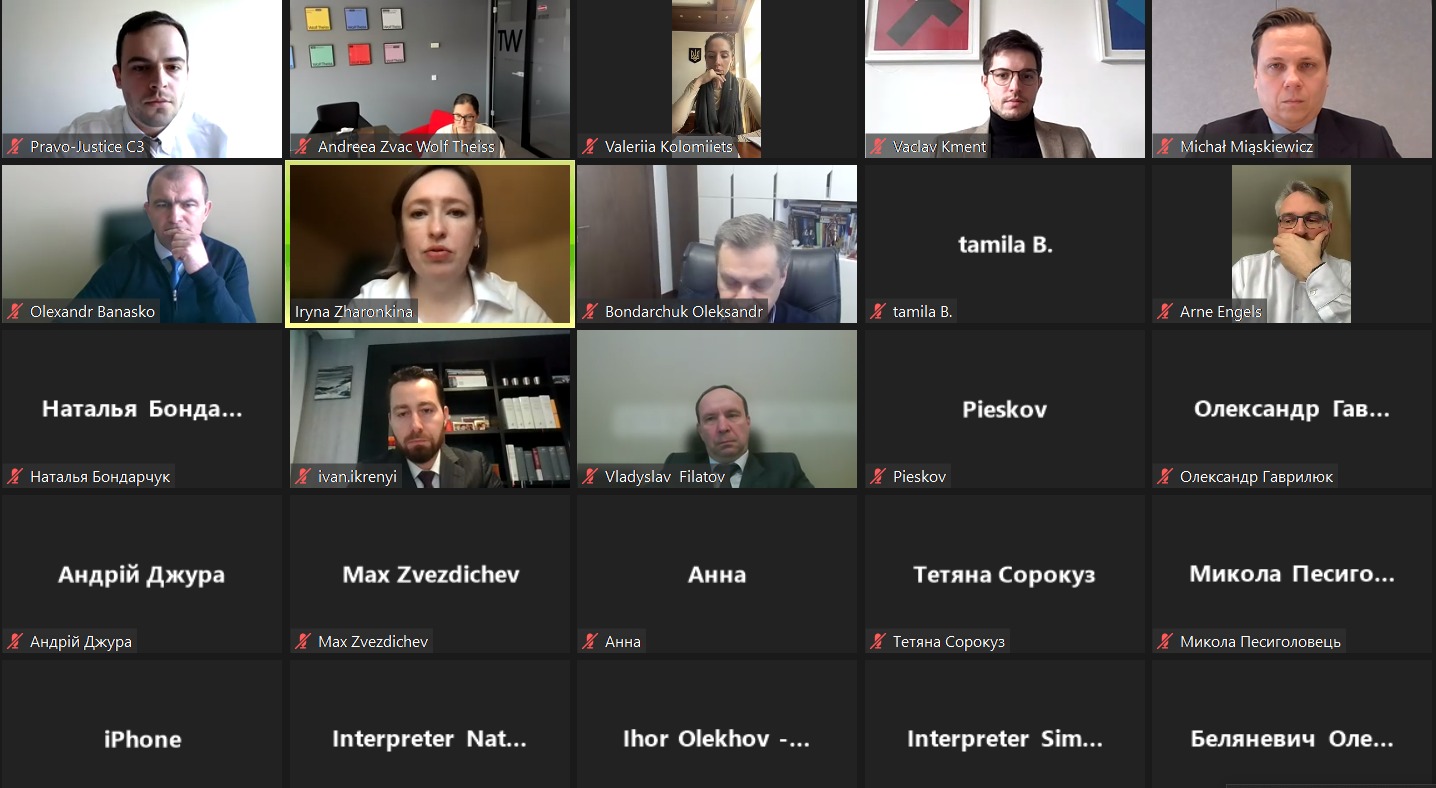

“European Insolvency Trends” – EU Project Pravo-Justice Held the Online Discussion Involving Experts from 5 European Countries

On March 14, the EU Project Pravo-Justice held the online discussion dedicated to “European Insolvency Trends.” At the event, the representatives of leading law firms from the Czech Republic, Poland, Germany, Slovakia, and Romania shared the experience of their respective jurisdictions regarding statutory and practical implementation of the key principles of the EU Directive 2019/1023 on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency, and discharge of debt.

It should be noted that under the memorandum with the EU regarding macro-financial assistance, Ukraine undertook to improve bankruptcy regimes in accordance with the key principles of the said EU Directive by the third trimester of 2023.

“We tried to make the online discussion as practical as possible, learn and analyze the experience of our colleagues from other countries as to the efficiency of restructuring and application of the EU Directive on preventive restructuring. Our another goal is to facilitate a dialogue between Ukrainian participants and their European colleagues in order to improve the Bankruptcy Code of Ukraine when implementing the Directive,” said Iryna Zharonkina, Lead of Property Rights Protection and Enforcement Component of the EU Project Pravo-Justice.

Valeriia Kolomiiets, Deputy Minister of Justice of Ukraine addressed the participants to the event with a welcome speech. She noted that the experience of Western partners regarding positive and problematic aspects of the Directive implementation would be especially valuable for Ukraine. “We undertook to implement the 2019 EU Directive by September this year. In order to do this, we need to develop a legislative architecture, which we will then submit for the consideration of the Verkhovna Rada. It is important that we learn the relevant experience of colleagues from other European countries,” said Valeriia Kolomiiets.

Vaclav Kment, Managing Associate in Kinstellar, developed on the Czech experience in the implementation of the EU Directive 2019/1023 on preventive restructuring and the peculiarities of the national legislation that regulates the issue in question.

“The Czech Republic is somewhat behind the schedule regarding the implementation of the Directive. We hope that the relevant bill will be passed by the end of 2023. Preventive restructuring is a new tool for our state,” said Vaclav Kment. According to Mr. Kment, Czech legislators propose that preventive restructuring be based on voluntary principles, with very limited supervision by the insolvency courts or the insolvency practitioner.

“Thus, the main challenge is to prevent unfair use of this mechanism by those debtors who try to avoid complying with their liabilities to creditors,” noted Vaclav Kment. Ivan Ikrenyi, Partner of IKRÉNYI & REHÁK LC, covered the peculiarities of insolvency regulation, including preventive restructuring, in Slovakia.

“In Slovakia, the change of legislation in connection with the implementation of the EU Directive took place back in July 2022, but it has not been applied in full yet,” said Ivan Ikrenyi.

At the same time, he added that thanks to the Directive, the national legislation was supplemented with more modern and advanced restructuring solutions. Another positive consequence of the harmonization of bankruptcy-related legislation, according to Mr. Ikrenyi is that the documents issued within a bankruptcy procedure will be recognized in the territory of other EU member states.

In his intervention, the expert presented in details the main stages and features of the application of the imminent insolvency procedure, which are currently used in Slovakia. According to him, there are two forms of the procedure: public preventive procedure or private preventive procedure.

“In Slovakia, a debtor who wishes to go for the preliminary insolvency procedure is entered into a special register. This is done in order to prevent the debtor from enter into economic relations with other counterparties, especially with State-owned ones, until his financial situation is restored,” added Ivan Ikrenyi.

Michał Miąskiewicz, Senior Associate at Eversheds Sutherland and certified restructuring advisor in Poland, shared his experience and outlined the shape and legal framework of insolvency and restructuring law in Poland. He presented the audience the main assumptions and principles of the Directive and informed that the legislative work of the Polish legislator to implement the Directive is still at an early stage. He pointed out that Poland has matched very well the legal order and requirements set by the European Union through the adoption of relevant laws and their subsequent amendments in the field of insolvency and restructuring law in previous years. Despite the fact that the Directive was not implemented yet, in Poland there are already three types of preventive restructuring.

According to him, the implementation of the Directive in Poland will lead to the strengthening, consolidation and improvement of restructuring and insolvency law, but the change itself will rather have an evolutionary character. He also raised the important issue of the legal and economic repercussions of the upcoming implementation of the Directive into the Polish legal order, focusing in particular on the significant increase in the already high costs of conducting restructuring proceedings in Poland, which helped to draw the attention of the discussion participants to the important and practical aspects of such proceedings.

He informed that starting from 2021, proceedings in Poland take place only in electronic form. According to him, the correct implementation and use of appropriate ICT systems in the conducting of restructuring and insolvency proceedings will allow the Ukraine to carry out these proceedings efficiently.

Andreea Zvac, Advisor at Wolf Theiss LC, spoke about how insolvency procedures are regulated in Romania and what challenges Romanian insolvency practitioners faced after the implementation of the Directive.

“Romania has already implemented the Restructuring Directive by an extensive amendment to the Insolvency Code, that includes now a unified and comprehensive regulation for the pre-insolvency restructuring mechanisms (including early warning, restructuring agreement and preventive composition) and insolvency procedures. There are several possibilities of entering the insolvency procedure – at the request of the debtor and at the request of the creditor. The decision is made by a special judge who deals with insolvency proceedings. The start of the procedure means the beginning of the observation period. At this stage, a large number of so-called tests is applied, which are designed to establish the real financial situation of a company and determine the possibilities of reorganization or restructuring. If the tests show that there is such a possibility, then the restructuring plan may be approved, if not, the actual bankruptcy procedure begins,” said Andreea Zvac.

In Germany, the EU Directive 2019/1023 on preventive restructuring was implemented into national legislation in 2021. However, the number of cases initiated under the said Directive does not exceed 100. That was reported by Arne Engels, lawyer of GORG LC, International Expert of Pravo-Justice Project, at the online discussion.

“If we look into general European trends, we can see a trend towards simplification of insolvency procedures, in particular, a decrease in cases where insolvency practitioners are involved. This applies to “small” cases where there is no need to conduct a financial examination,” said Arne Engels.

Summarizing the event, Iryna Zharonkina announced that the EU Project Pravo-Justice is planning to summarize the experience of European countries presented at the online discussions. The summary report will subsequently be submitted for study to the Ministry of Justice of Ukraine with the aim of developing changes to the legislation in the field of insolvency.